salt tax limit repeal

GOP lawmakers imposed the deduction cap in 2017 with the passage of the Tax Cuts and Jobs Act which slashed the corporate tax rate to 21 and cut individual income. D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid.

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

If the cap were.

. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. This significantly increases the boundary that put a cap on the SALT.

After donald trumps 2017 tax. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the. New limits for SALT tax write off.

Sanders Would Partially Repeal The Salt Cap. Senate Budget Committee chair Bernie Sanders will include a partial repeal of the Tax Cut and Jobs Acts 10000 cap on the. Repeal the SALT deduction limit for LIers.

Sanders would partially repeal the SALT cap. The change may be significant for filers who itemize deductions in. Raising or repealing the 10000 limit on the SALT deduction a change imposed by the 2017 Republican tax overhaul is one of the most politically charged aspects of the.

SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of high-tax states like New York and New. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging. After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say they will still vote for the partys. August 9 2021 833 AM 3 min read.

The deduction was unlimited before 2018. President donald trumps 2017 tax reform. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions.

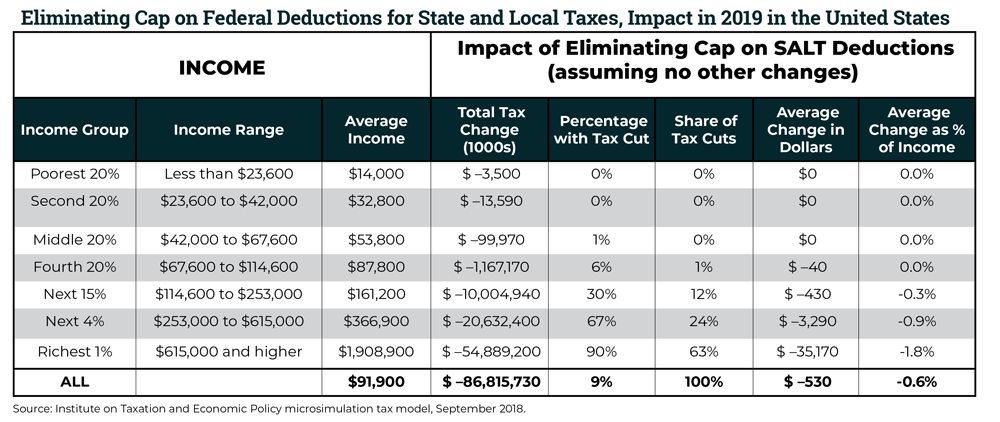

Improving Lives Through Smart Tax Policy. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. Between 2022 and 2025 the cost of repealing the cap.

The lawmakers have asked. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. New limits for salt tax write off.

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

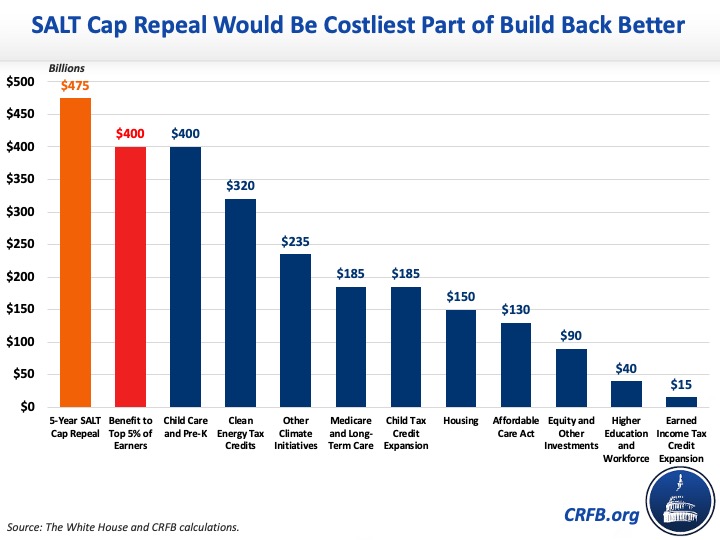

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

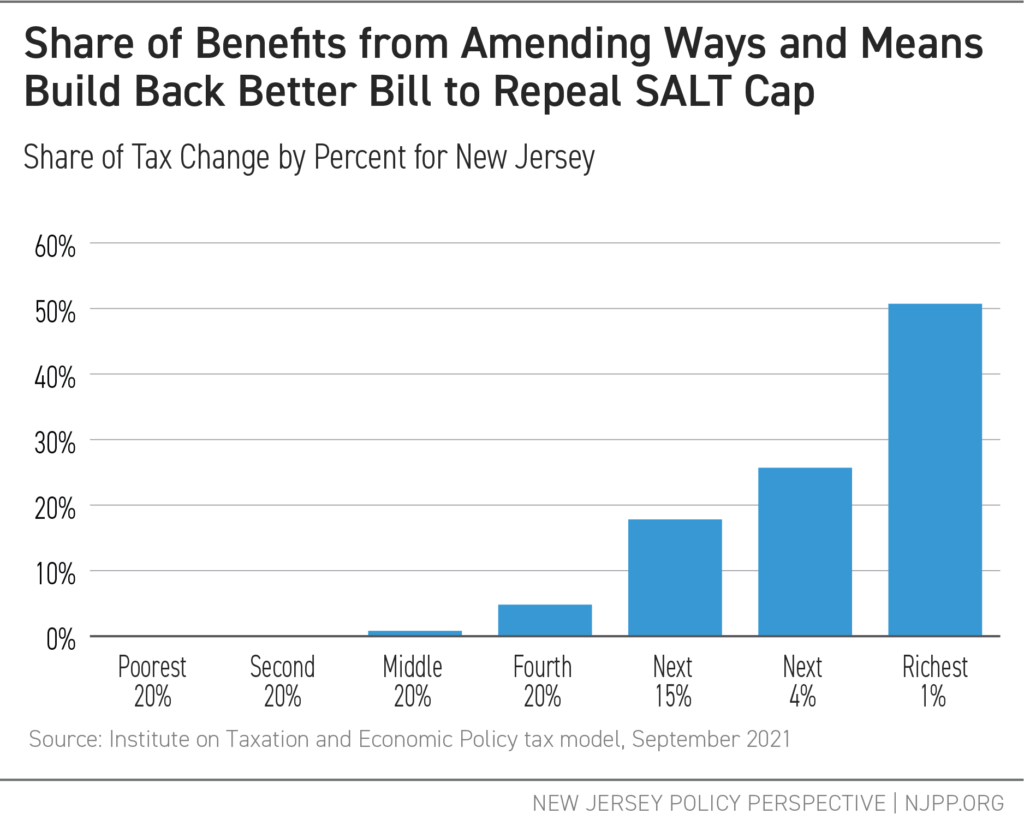

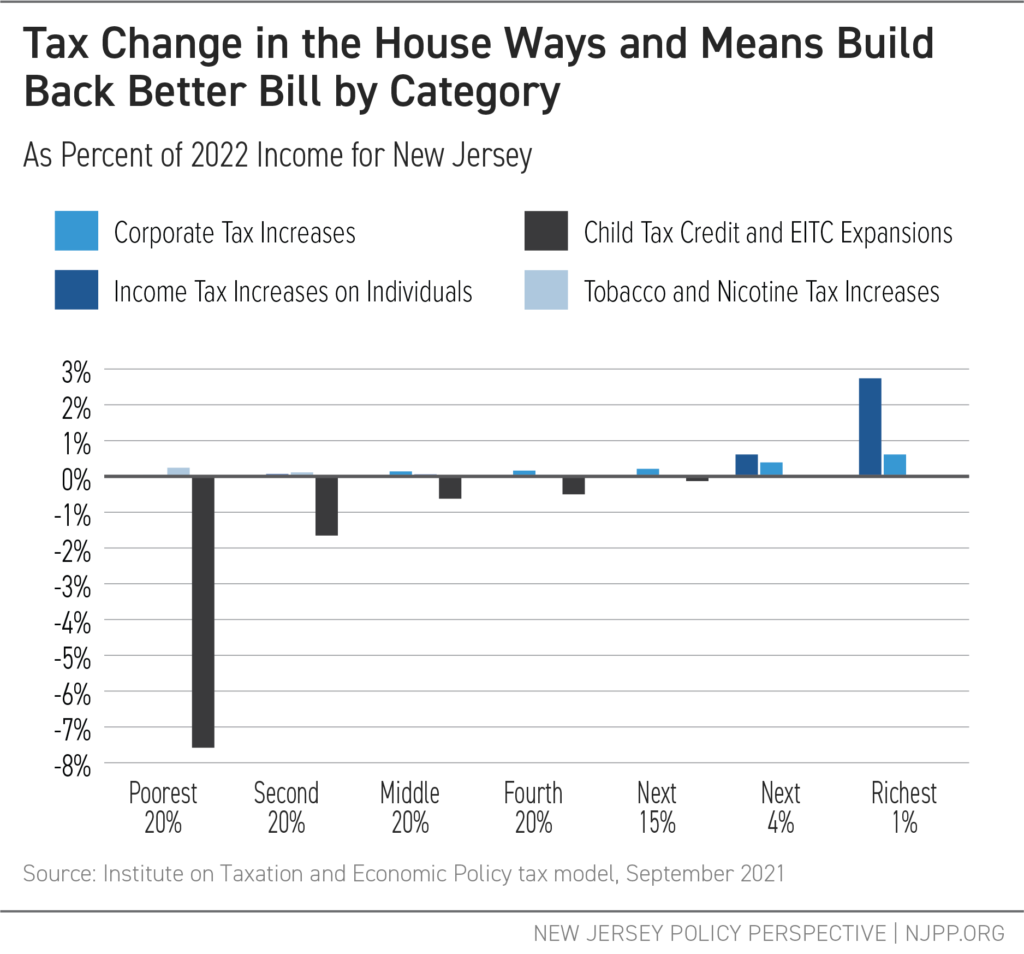

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

House Lawmakers Launch Group To Fight For Salt Cap Repeal Route Fifty

High Tax State Push To Repeal Salt Cap A Boon To The Rich Fox Business

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

U S House Passes Legislation To Repeal Salt Deduction Cap For Two Years Focus Turns To Senate Efforts

Salt Cap Repeal Will Be Just Another Nice Thing For High Earners Bloomberg

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Deduction That Benefits The Rich Divides Democrats The New York Times

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

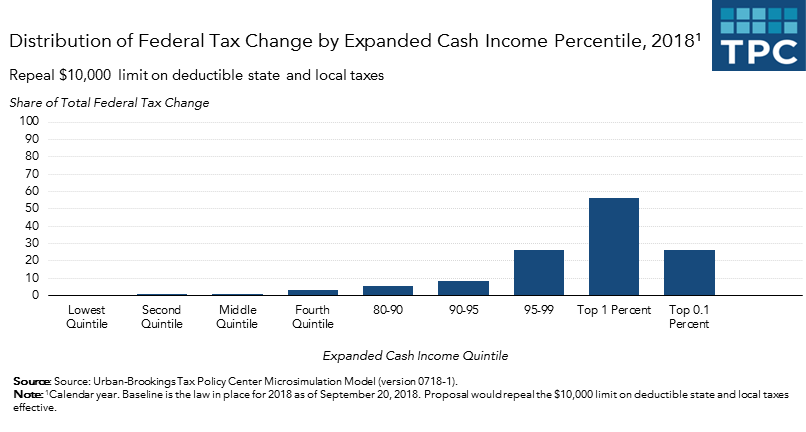

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Tax Policy Center

Salt Cap Repeal Unlikely Addition To Covid 19 Relief Bill Orange County Register

Dems Renew Demand For Salt Tax Repeal Threatening Biden S Spending Proposals Fox Business